Pension provision for part-time work: prevention is better than cure

09 May 2023 | Comment(s) |

Guillaume Chassot

Whether you're going to become a parent, or simply want to enjoy life or carry out a personal project, part-time work has consequences when it comes to occupational pension provision. Even when retirement seems a long way off, it's important to bear in mind that there can be a decrease in your 2nd pillar occupational benefits when you choose to work part-time. Read our explanations below.

What does Swiss law say about occupational pension provision?

In Switzerland, the law requires that employers affiliate employees who have a gross annual income of more than CHF 22,050 to the 2nd pillar pension scheme (LPP/BVG). This means that people earning less than CHF22,050 a year (e.g. part-time workers) may not be affiliated. In this case, no pension provision contributions are collected.

The LPP/BVG insured salary is calculated based on your gross annual salary, less the coordination deduction of CHF 25,725.

However, it should be noted that some pension funds, through the employer, offer better conditions.

Women, the majority of whom work part-time, are often at a disadvantage

Let us take the fictious example of Mathilde, aged 40 with two children, who started to work part-time when her first child was born eight years ago. As a marketing project manager, she currently earns CHF 3,500 per month, i.e. CHF 42,000 per year.

To calculate her LPP/BVG insured salary, the coordination deduction is deducted from her gross annual salary and the result is an LPP/BVG insured salary of CHF 16,275. Therefore, the LPP/BVG pension contributions will be deducted from this amount. In general, the coordination deduction remains identical for both full-time and part-time workers. This is a major inconsistency, which puts Mathilde and others who want to reduce their working hours at a real disadvantage.

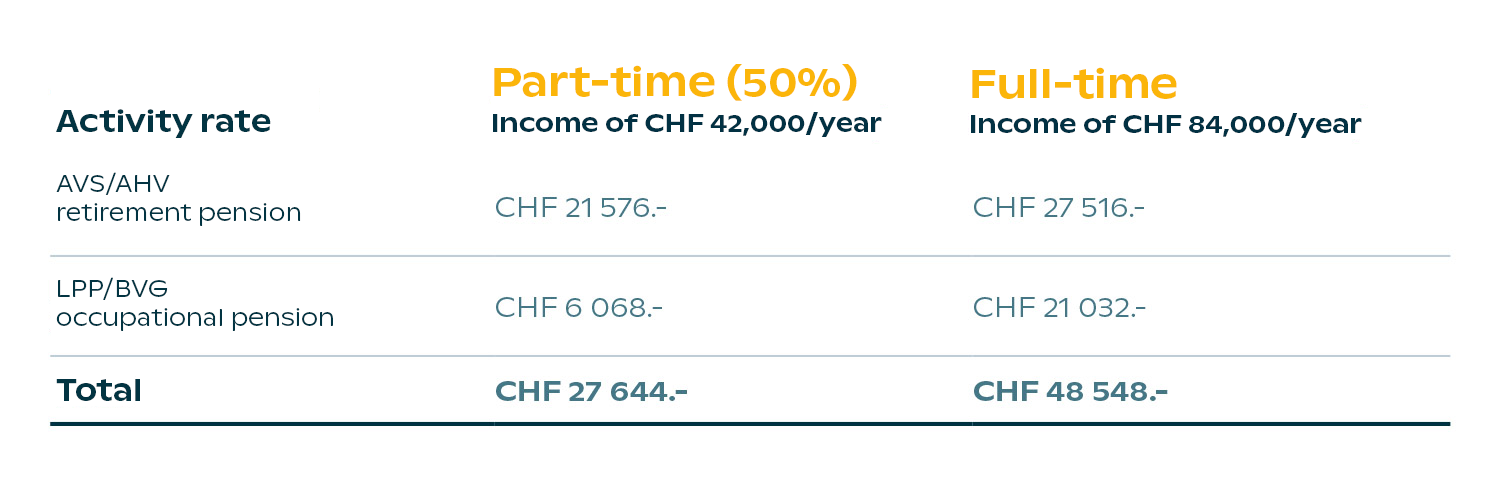

Let us now take a closer look at the impact of decreasing her working hours on her future retirement pensions, by comparing her current income with what she would have earned had she continued to work full-time:

In terms of 2nd pillar pensions, the impact is very significant. The fact that Mathilde works half-time will drastically reduce her LPP/BVG retirement pension.

It's important to note that the above example reflects the situation at retirement, but it will certainly be identical in the event of disability or death.

The solution: choose a 3rd pillar scheme to fill the gaps

Our pension specialists are able to assess your situation and clearly demonstrate, based on your private and professional circumstances, what benefits you could claim on retirement or in the event of disability or death.

If any gaps in your pension provision are identified (i.e. the difference between your financial needs and the benefits provided under the 1st and 2nd pillars), our various pension solutions in the form of a 3rd pillar will enable you to fill them.

Whenever there's a major change in your life (marriage, birth of a child, buying a property, change of job, etc.), it's always a good idea to take into account the aspects relating to your pension provision and the changes involved.

In the case of Mathilde, who works part-time, it's essential that she is able to take advantage of the possibilities offered by the “3rd pillar A”. The contributions will enable her, over time, to build up a lump sum with the aim of improving her retirement benefits, while at the same time benefiting from significant tax savings, since the premium is deductible from her taxable income. The advantage is therefore twofold!

What's new in 2023

From 1 January 2023, you will also be able to make maximum contributions to your “3rd pillar A” (total for all pension solutions):

- For working people affiliated to a pension fund, a maximum of CHF 7,056 per year.

- For working people not affiliated to a pension fund, 20% of their net income, but a maximum of CHF 35,280 per year.