Premium invoices, payment options and subsidies

Find the information you need to understand your premium invoices, the payment options available and how subsidies work.

Find the information you need to understand your premium invoices, the payment options available and how subsidies work.

When do you receive them?

You receive them at the frequency you have chosen: monthly, quarterly, biannually or annually. You can change the payment frequency at any time in your Customer Area (for invoices that have not yet been issued).

What information appears on your premium invoice?

Your invoice shows the amount you need to pay for your health insurance (basic and supplemental) and the insurance period covered.

Read more

What do you need to do?

Pay the amount shown before the due date using your preferred payment method. We recommend that you use the eBill portal in your e-banking so that you can easily pay the amounts due.

You can display, download and check the status of your invoices at any time in your Customer Area.

See your invoices

Read more about the Customer Area

For your information, payment by Twint is not available.

What’s a subsidy?

A subsidy is financial assistance granted by your canton to help you pay your basic health insurance premiums. Depending on your financial and family situation, you may be eligible for a premium reduction (cantonal subsidy) granted by your canton of residence. The decision is made by your canton. Groupe Mutuel is not involved in the decision-making process.

What must you do?

If you are not already receiving a subsidy, you can visit your cantonal office's website or contact them to find out whether you are eligible. Submit your application if necessary. If you are already receiving a cantonal subsidy and you change insurers, you do not need to take any action until you hear from your cantonal office.

When do you receive it?

The process can take several months, involving two stages: the decision (or amendment of your file with the canton) and the administrative processing of your file by Groupe Mutuel.

You sign a contract binding you to Groupe Mutuel

You conclude your insurance contract with Groupe Mutuel. The subsidy is never shown on the insurance certificate.

You are already receiving a subsidy

There is nothing you need to do: you will have to be patient, as it may take some time for your file to be processed by the canton. If you have not heard anything after three months, please contact the cantonal office.

You are receiving premium invoices without the subsidy deduction

While awaiting the cantonal decision, you will receive your invoices at the chosen frequency, but without the subsidy deduction. You must pay the invoices by the due date.

You can extend the payment deadline for an invoice

You can request an extension of the payment deadline yourself from your Customer Area (up to three extensions per year). Simply display the invoice in question and click on the “Extend” button.

The canton will inform you of its decision concerning your entitlement to subsidies

Once the decision has been made, if the insurer is known, the canton will automatically send a notification to Groupe Mutuel.

Groupe Mutuel will inform you when it receives a decision

You will receive a new invoice based on the subsidy amount granted by the canton, along with a document explaining the decision.

This invoice will indicate the amount that will either be reimbursed to you or that is payable to Groupe Mutuel for the period in question.

If you have not received a response from the canton within three months, please contact your cantonal office directly to check the status of your application.

Groupe Mutuel cannot provide you with any information as this process is managed only by your canton.

When do you receive adjustments to your premium invoices?

What are they intended for?

What must you do?

If you are experiencing financial difficulties, you can extend the payment deadline directly in your Customer Area (up to three extensions per year). Simply display the invoice in question and click on the “Extend” button.

See my invoices

You can easily check the status of your invoices in your Customer Area using the relevant filters (paid, to be paid, reminder, etc.).

See my invoices

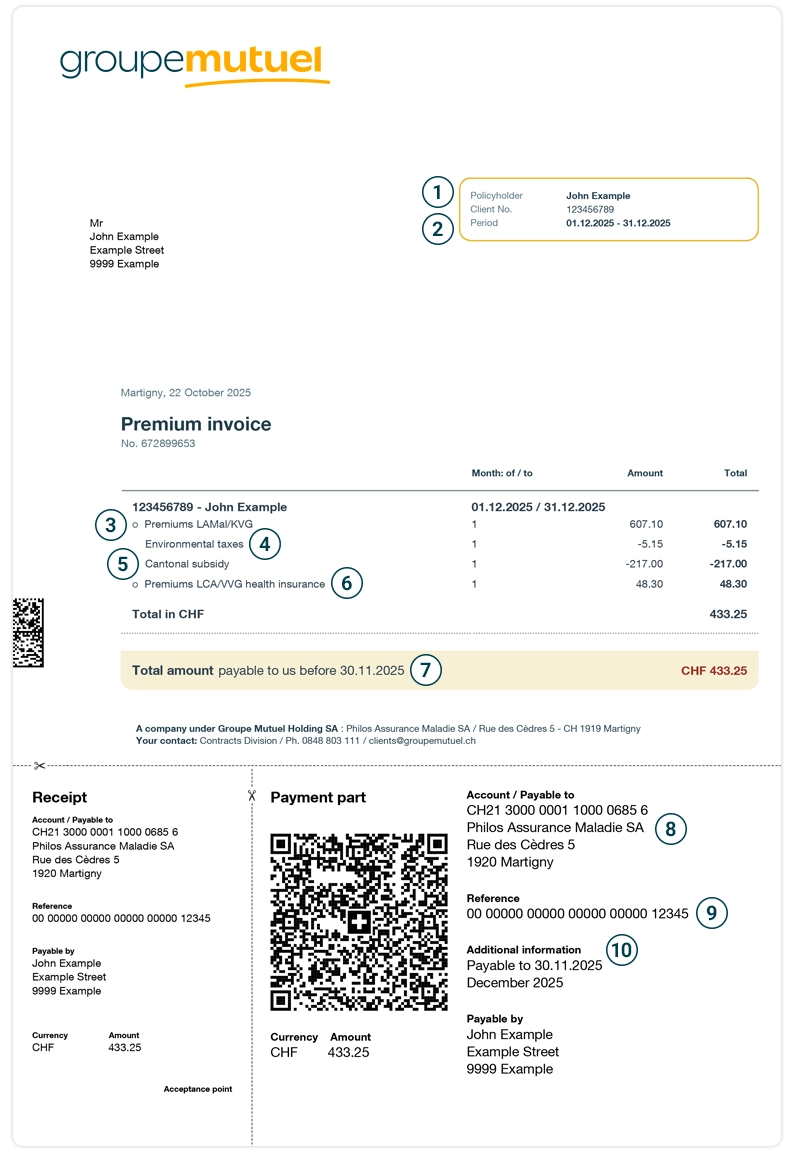

1

Client number

Personal number used to identify you at Groupe Mutuel. This is also sometimes referred to as your “Partner number” or “Insurance number”.

2

Invoice period

The period covered by the premiums indicated on this invoice.

3

Basic insurance premiums

In accordance with the LAMal/KVG (Federal Law on Health Insurance).

4

Redistributed environmental taxes

The portion of federal taxes redistributed to the population by health insurers.

5

Cantonal subsidy

Premium reduction granted by your canton.

6

Supplemental insurance premiums

According to the LCA/VVG (Federal Law on Insurance Contracts).

7

Total amount

Also includes the invoice due date (Reminder: premium invoices are issued to cover the insurance period for the following month.)

8

Account / payable to

Includes the account number and payment recipient information.

9

Reference

Unique reference number for this invoice. (It includes the insurance company number, customer number and invoice number.)

10

Additional information

Includes the invoice due date and the period covered.

It is important not to change the information on the QR-invoice and to pay the invoice by the correct due date.

(cost-sharing amounts and reimbursements)

We help you to understand and check which amounts are reimbursed, which are payable by you and why.

Find out how the insurance system works in Switzerland, as well as the principle of solidarity, the different insurance models and the cost-sharing system (deductibles and co-payments).

Read more

Do you need a document? Or do you need to change your personal details for example? Send all your requests in just a few clicks!

Read moreShare