Principles

-

The insurance:

- pays a daily allowance benefit to employees who are prevented from working because of illness or maternity;

- takes effect at the end of the chosen waiting period (3, 7, 14, 30, 60 or 90 days).

Daily allowance insurance protects your employees against loss of salary in the event of illness. It also allows you to budget the costs of such risks. Discover our LAMal/KVG insurance solution and its many advantages.

Daily allowance pursuant to LAMal/KVG

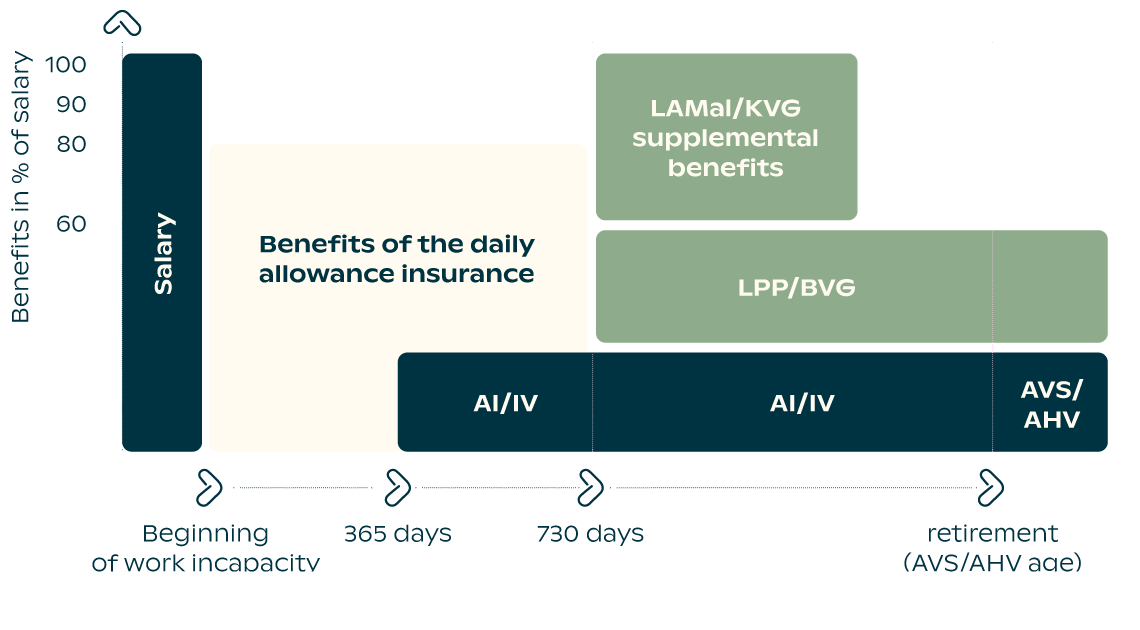

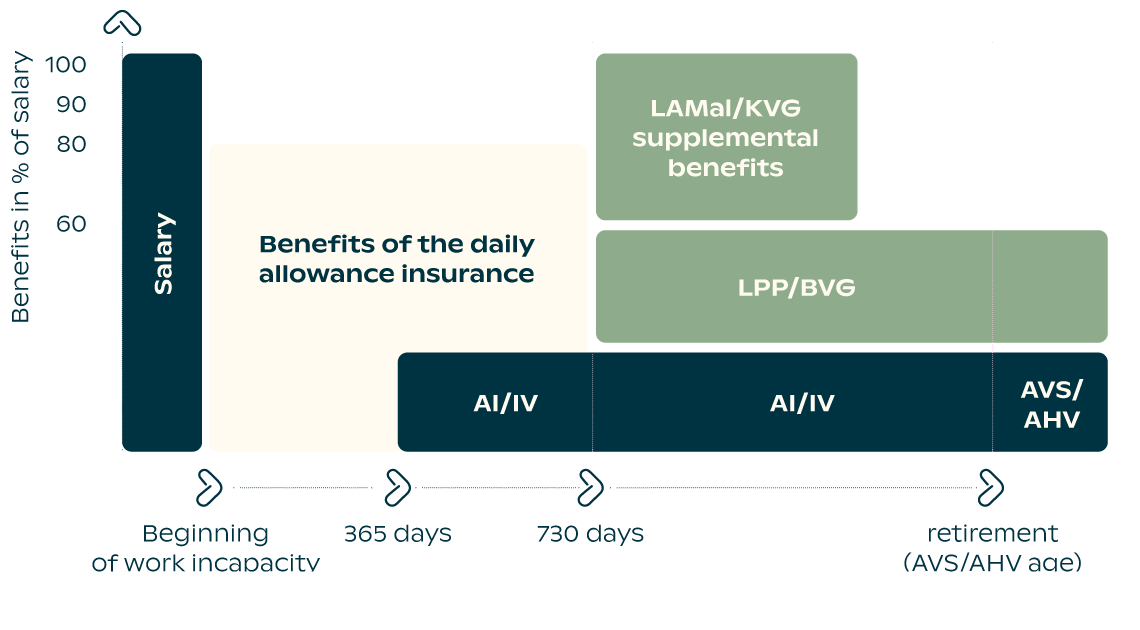

Level of coverage

Maternity daily allowance

Additional coverage (optional)

Individual insurance

Use the corporate online offers system to send us your information, without any obligation on your part. Once assessed, we will be able to send you a personalised offer.

By phone

0848 803 777

08.00 – 12.00

13.30 – 17.00

On the Swiss landline network: national rate / On the Swiss mobile network: according to your mobile network operator

Meet an adviser

Your incapacity for work should be reported immediately to your line manager or to your human resources department.

Every month, you should give your employer a doctor's certificate signed by your doctor attesting to the degree of incapacity. To facilitate matters, the insurer has produced a special form for long-term incapacities, and this form is available on request. Your doctor should fill in the form at each consultation. You should then give your employer a copy of the form. At the end of the incapacity for work, you should send you employer the original form without delay.

When you are incapacitated for work, you should:

You must notify us immediately of your departure from the company (within 90 days of leaving the circle of insured persons) and specify that you wish to be offered a free transfer to individual insurance. If you accept this offer, you will continue to enjoy insurance coverage under the same conditions as when you were employed by the company. You will be responsible for paying the premium associated with the policy.

Share